I despise overly hyped things as much as anyone. If 25 years in the radio business taught me anything, it’s “under promise and over deliver.”

So it could be said that I am violating that here by promising to change the lives of people interested in buying their first home.

I’ll give you a teaser on one of the things we are going to cover at the event on Feb 16th. How to lock in your monthly housing payment and actually lower your rent over time.

Let’s do an example using real world numbers.

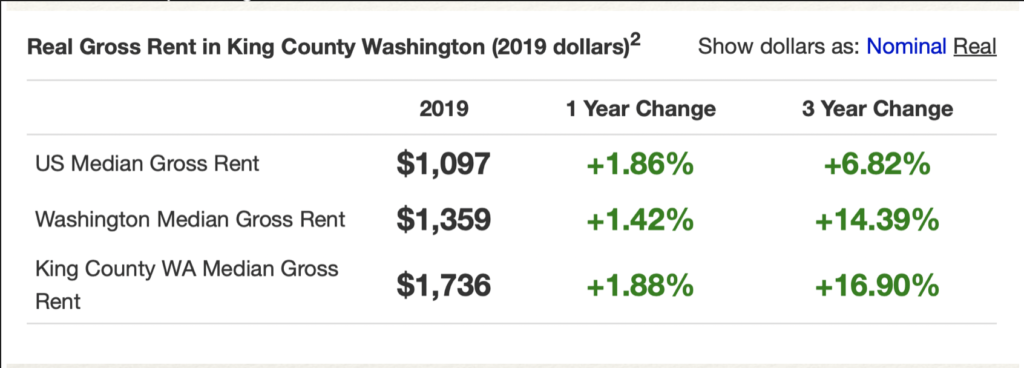

*From www.deptofnumbers.com using US Census data

If you’ve been renting in the Puget Sound area, then you already intuitively know this graphic to be true. Rent’s have been rising quickly. Jumping up almost 17% in three years is a tough hurdle to jump for many people.

Now let’s do a hypothetical with home ownership. This is basically my story on my primary home.

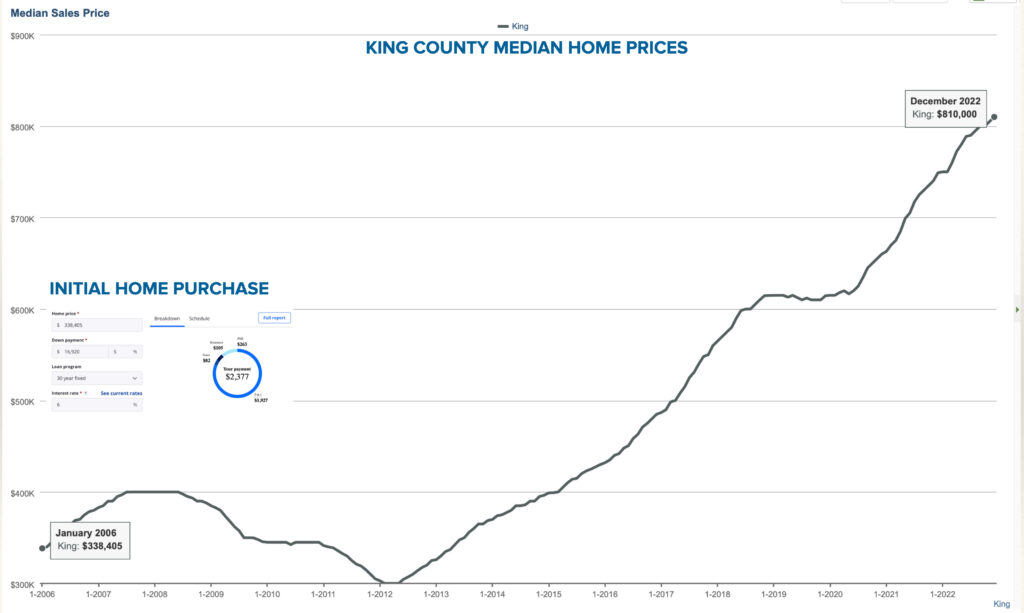

Let’s jump in the Way Back Machine and land in the year 2006.

The median price for a home in King County was $338,405. Purchasing this prototypical home then with just 5% down on a standard conventional loan would cost you $2,377. That’s expensive, I know. But remember, this is the median price – meaning half of the homes sold that year were less than this number.

Every single time I’ve purchased a home, it always initially felt expensive, and this would be no exception. However, look at few things:

First, since we put 5% because it was our first home, we are required to pay PMI (private mortgage insurance) of $263 a month. The way to get this removed is to either put 20% down or wait till your loan to value ration is under 80%.

Second, notice that the interest rate in 2006 on a conventional loan was 6%. Not great by recent standards.

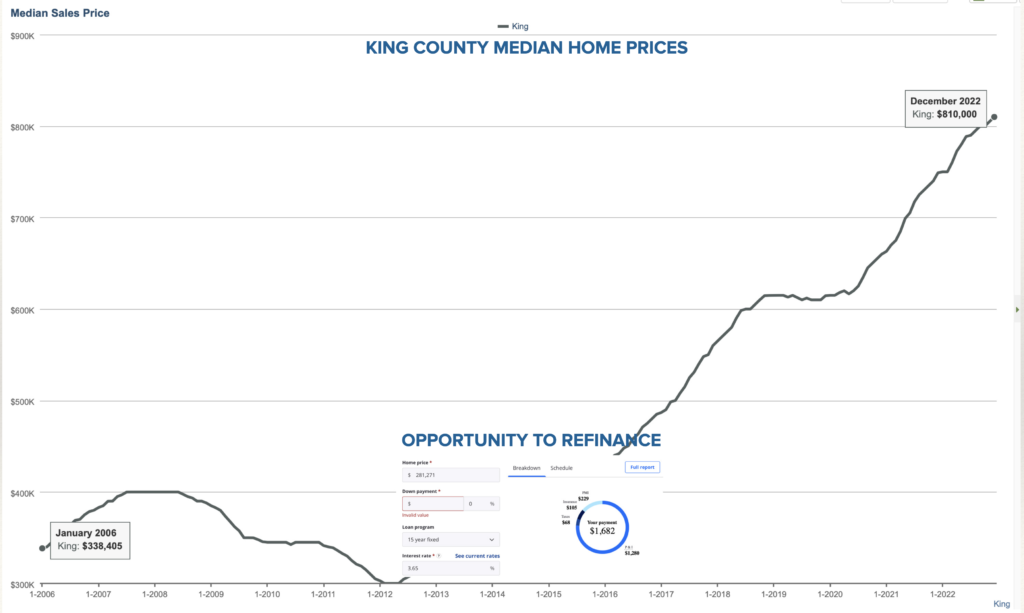

That takes us to 2008-2012 – The Great Recession. If you’ve seen the movie The Big Short, you’ll know all about how the financial systems melted down connected to housing.

You’ve been in your home, making your mortgage payment every month – just chugging along. Fast forward to 2012. The economy is in rough shape, and the FED tries to boost things by lowering interest rates. This is a great time to refinance this loan and lower your monthly payment.

So check this out. Again, using real historical numbers. You could have refinanced your existing loan, (which now had a balance of $281,271) to a 15 year mortgage with a lower interest rate, and your monthly payment drops by $695 a month. Same home, you shaved 9 years off the length of the loan, and put a lot more money in your pocket at the end of each month.

As they used to say on the late night infomercials, “But that’s not all!”

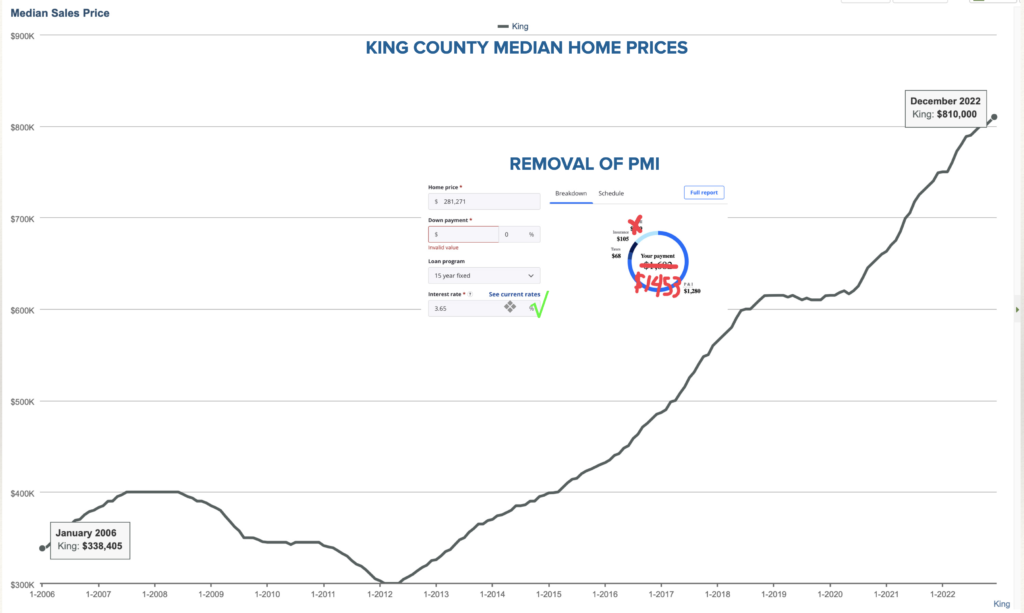

Flash forward a few more years as the real estate market rebounded, and now your loan to value is under that 80% threshold. What does that mean?

You guessed, removal of the PMI.

So now as rents are rising all around you, and the economy in the Puget Sound Area is growing on steroids, your new monthly payment is $1,453. That’s $884 LESS than when you bought the house.

And you’ve been getting the tax benefits of being an owner year after year.

In addition, now you have equity in your home that you can access if needed.

This isn’t a pie in the sky example either. I did pretty much exactly what I described here except some of the dates are a little different. Step by step. I currently have a 15 year loan with no PMI, and my payment has gone down since I first purchased the home.

If this type of strategy resonates with you, I hope you’ll grab one of those final two spots in our life changing event.

It’s Feb 16th from 6-8pm.

Sign up at www.ronanddon.com/change

See you next week.

-Ron